How to Build an ICP Model Your Team Actually Trusts

If you’re doing account-based anything, you need to work the right accounts. But too many companies find themselves wasting marketing, sales, & CS resources working accounts who aren’t in their true ICP.

This piece shares a solution. Our ICP Modeling Methodology has helped fast-growing B2B companies like Iterable, Ashby, Thoropass, Mutiny and more focus their sales & marketing efforts on accounts they know are good fits. This playbook walks you through exactly what an ICP Model is and Keyplay’s step-by-step methodology for building one that your team actually trusts, so you can finally feel confident you’re working the right accounts.

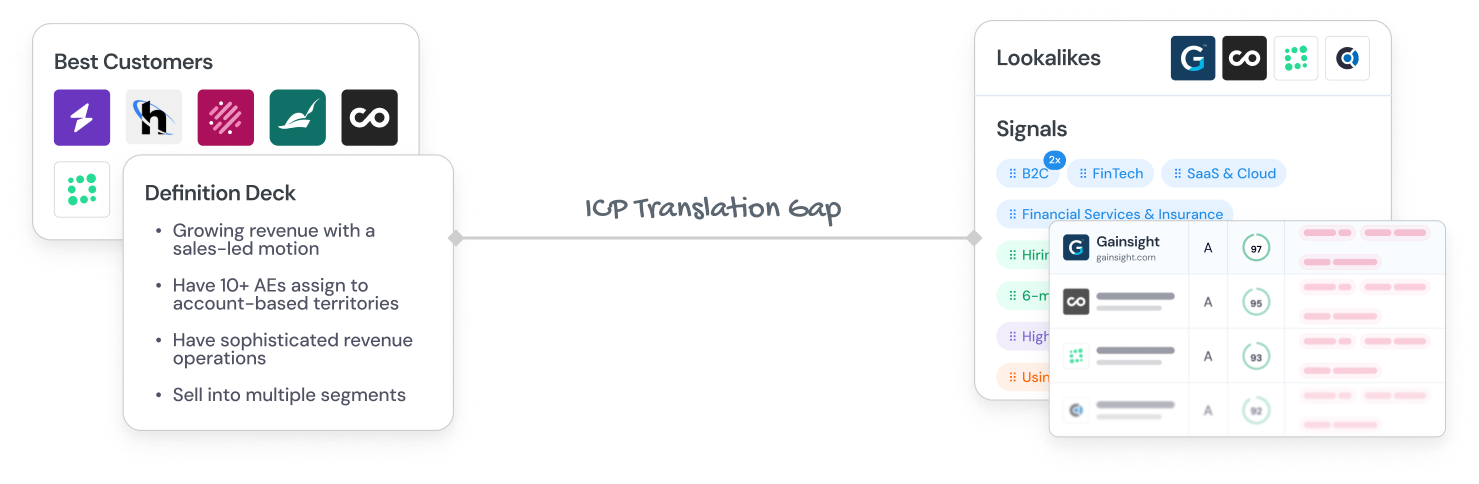

The ICP Translation Gap

For 2 years, we've been talking to B2B companies about their ICPs.

Most don’t have an ICP definition problem, they have a translation problem.

The exec team can describe their ideal account. The AEs and SDRs “know it when they see it.” There’s often a slide that everyone can agree about. They know the difference between a dream account and a DQ.

But that PowerPoint slide never gets translated into scoring that the team actually trusts.

There’s a translation gap.

So they end up with bloated and inaccurate target account lists that waste sales & marketing resources on poor-fit prospects.

There’s a better way: building an ICP Model.

Closing the Translation Gap

An ICP Model is the most effective way to close that gap.

Instead of relying on salespeople manually researching accounts or overly simple firmographic filters, a good ICP Model will be able to look at every account in your SAM and spit out a 0-100 fit score that you can use to discover & prioritize accounts. It will translate your ICP description into a quantifiable, inspectable, and improvable model that your team can actually act on.

Here’s how:

An ICP Model looks at inputs like lookalikes and signals.

.png)

And combines them to give each account in your SAM a concrete fit score.

A Good Model Backtests

Your model will never be perfect on the first try. And you shouldn’t have to wait months, costing you time and trust, for the feedback you need to iterate and improve.

Backtesting your model is a practical solution.

✨[Keyplay lets you backtest your model in a couple clicks. Check it out here!] ✨

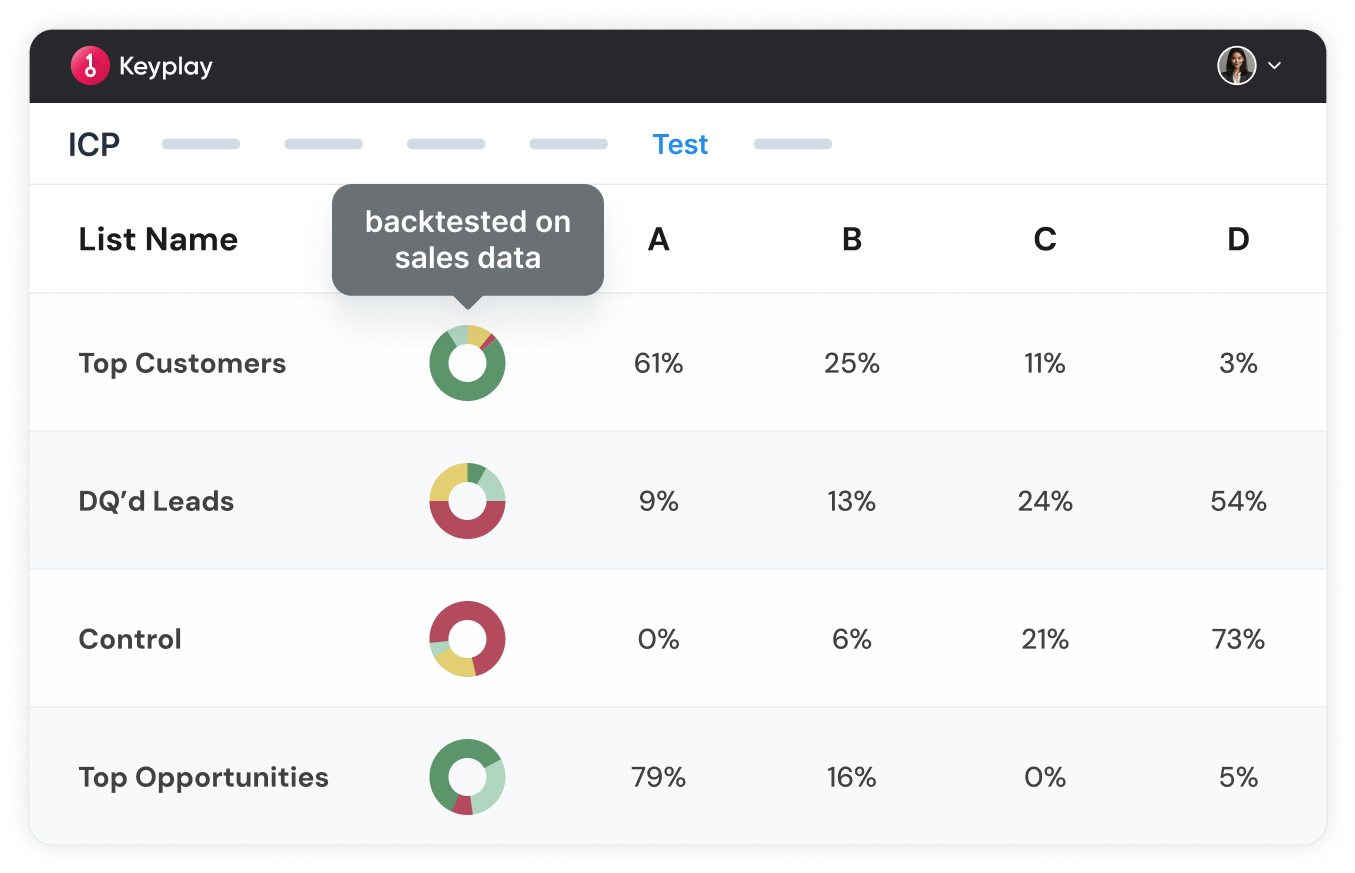

Looking at how accurately your model scores your best customers and your DQ’d leads (who sales hates talking to) gives you a concrete measure you can use to prove and improve your model.

An example from a recent customer:

Keyplay’s ICP Modeling Methodology

Building your ICP Model boils down to 4 things:

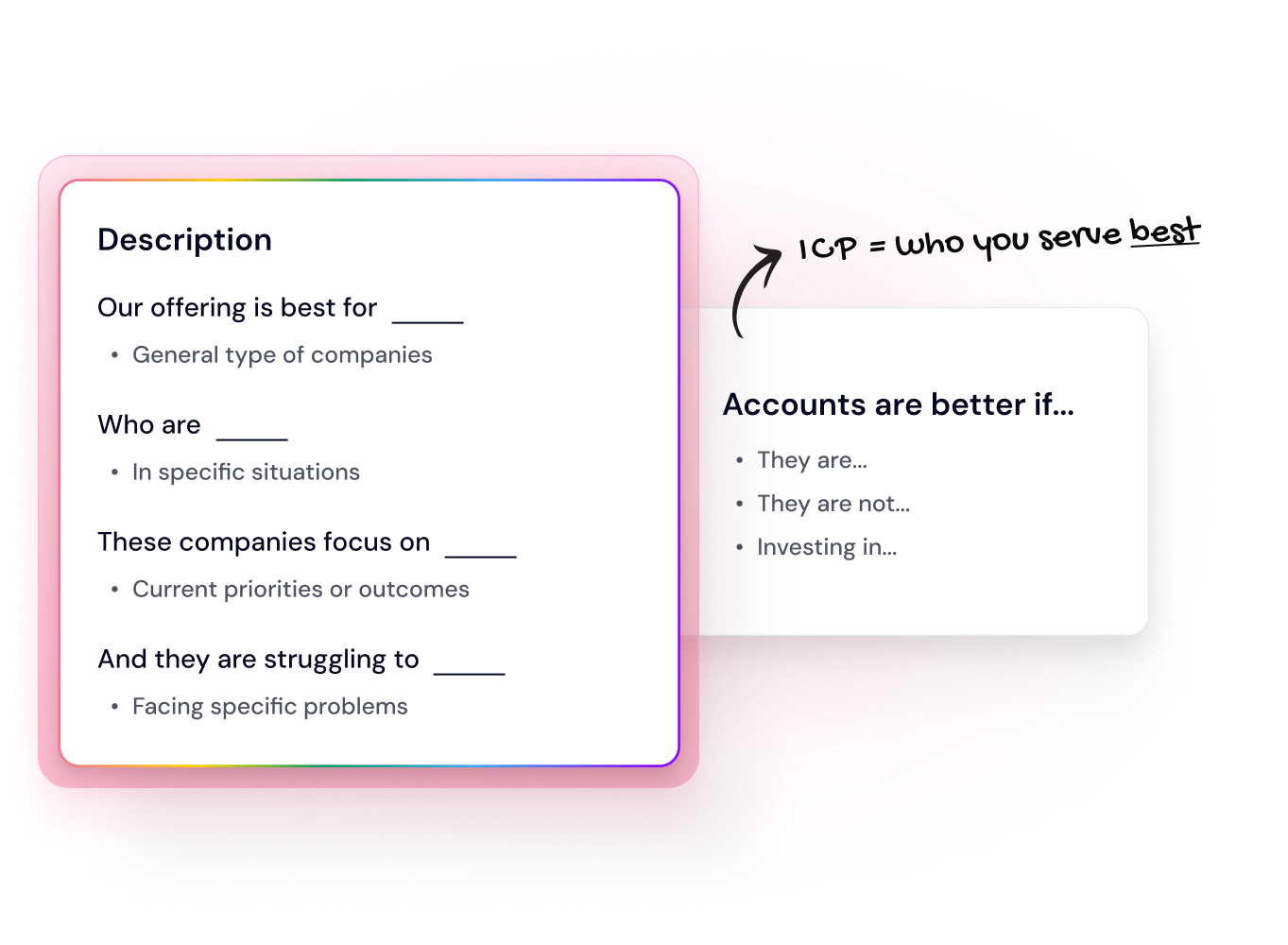

1) DEFINE

What does an A+, 100/100 account look like? Most companies have an answer to this question. This template will help.

Here’s what our ICP Definition looks like for Keyplay:

“We are best for B2B SaaS companies with 100-2,000 employees in the US and Canada.

Our ideal customers are growing revenue with a sales-led motion, have 10+ AEs assigned to account-based territories, have sophisticated revenue operations, and sell into multiple segments, markets, use cases, or verticals. They focus on sales effectiveness, territory planning & optimization, outbound pipeline generation, and account-based advertising & demand generation. These companies struggle to prioritize accounts for sales and marketing due to poorly defined or inaccurate ICP methods and models.”

We use “better if” statements to go deeper.

Better if growing AE and/or SDR teams.

Better if using Salesforce or Hubspot as source of truth.

Better if selling to multiple verticals.

Better if a territory planning project is coming up.

Better if RevOps team in-house.

When we work with late stage prospects and customers to get to a definition we trust, we start with qualitative insights, then we use data to validate or invalidate them and surface additional patterns.

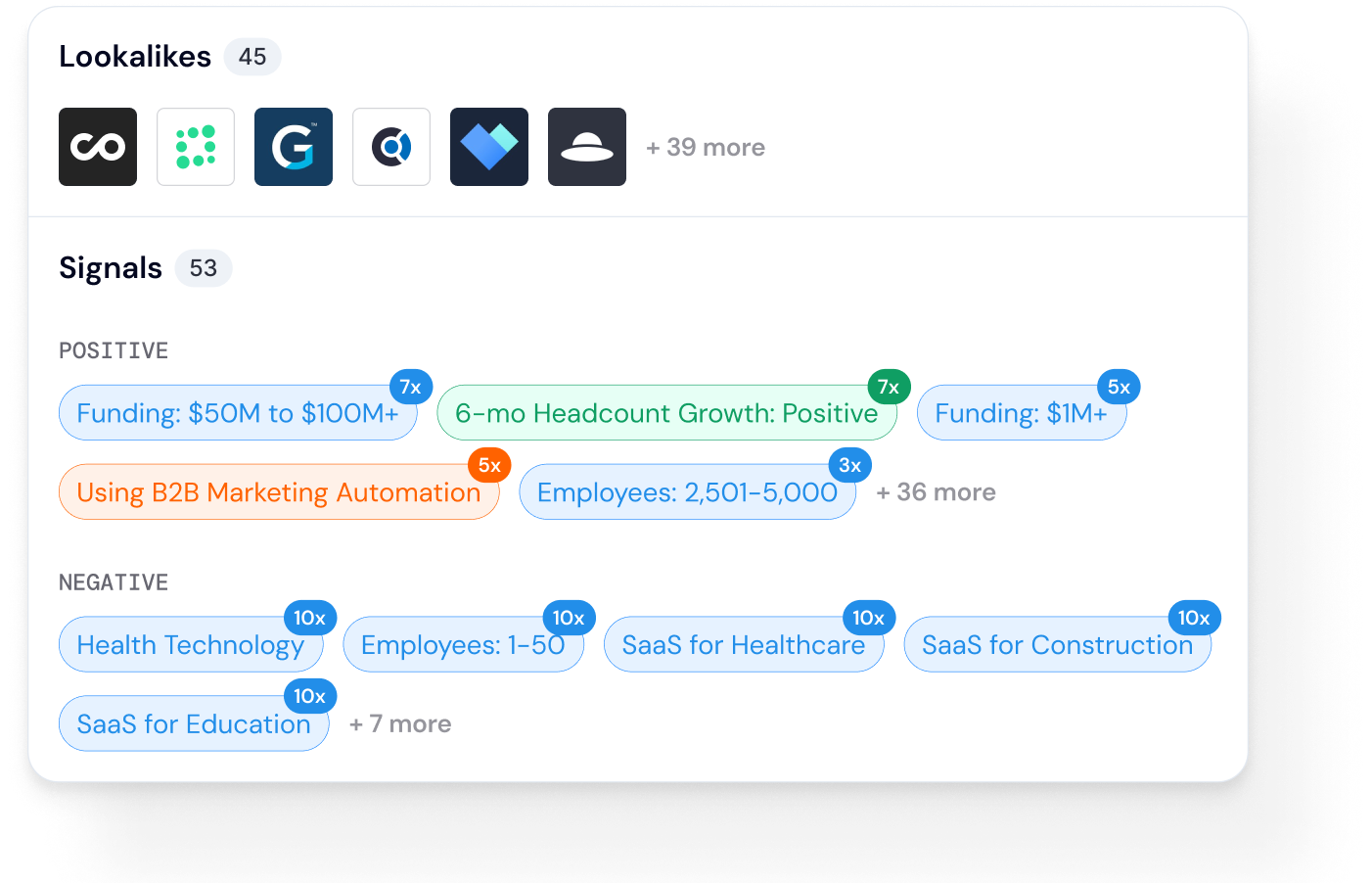

We recently went through this process with a Keyplay customer. We’ll call them Boltshift (we changed the data here slightly to maintain anonymity).

Qualitative insights for them looked like:

Boltshift’s best customers are growing quickly

They tend to be mid-sized, VC backed

They’ve often raised lots of VC

Often have lots of web traffic/a big brand presence

Then we used data to validate or invalidate them, and surface additional patterns or proxies:

Boltshift top customers tend to be mid-sized, VC-backed, modern & emerging companies, with strong brand presence (web traffic and social followers).

Boltshift top customers tend to be growing headcount in recent months. Of the venture-backed companies, more funding appears to be a good indicator of account fit.

Boltshift has successful customers across a wide range of industries with a concentrated focus in SaaS, Consumer Products (largely DTC), Online Marketplaces, and Fintech. Within these industries, some interesting secondary categories appear – eg. Payments (SaaS/Fintech), Personal Finance (Fintech), Beauty & Home (CPG). These categories likely correlate with high volumes of customer success and a emphasis on brand and customer experience.

Signals like Mobile marketing, AI messaging, Remote work, and Planned Investments in Data Teams and Marketing/Growth all seem to correlate with fit.

These insights will turn into analysis like this:

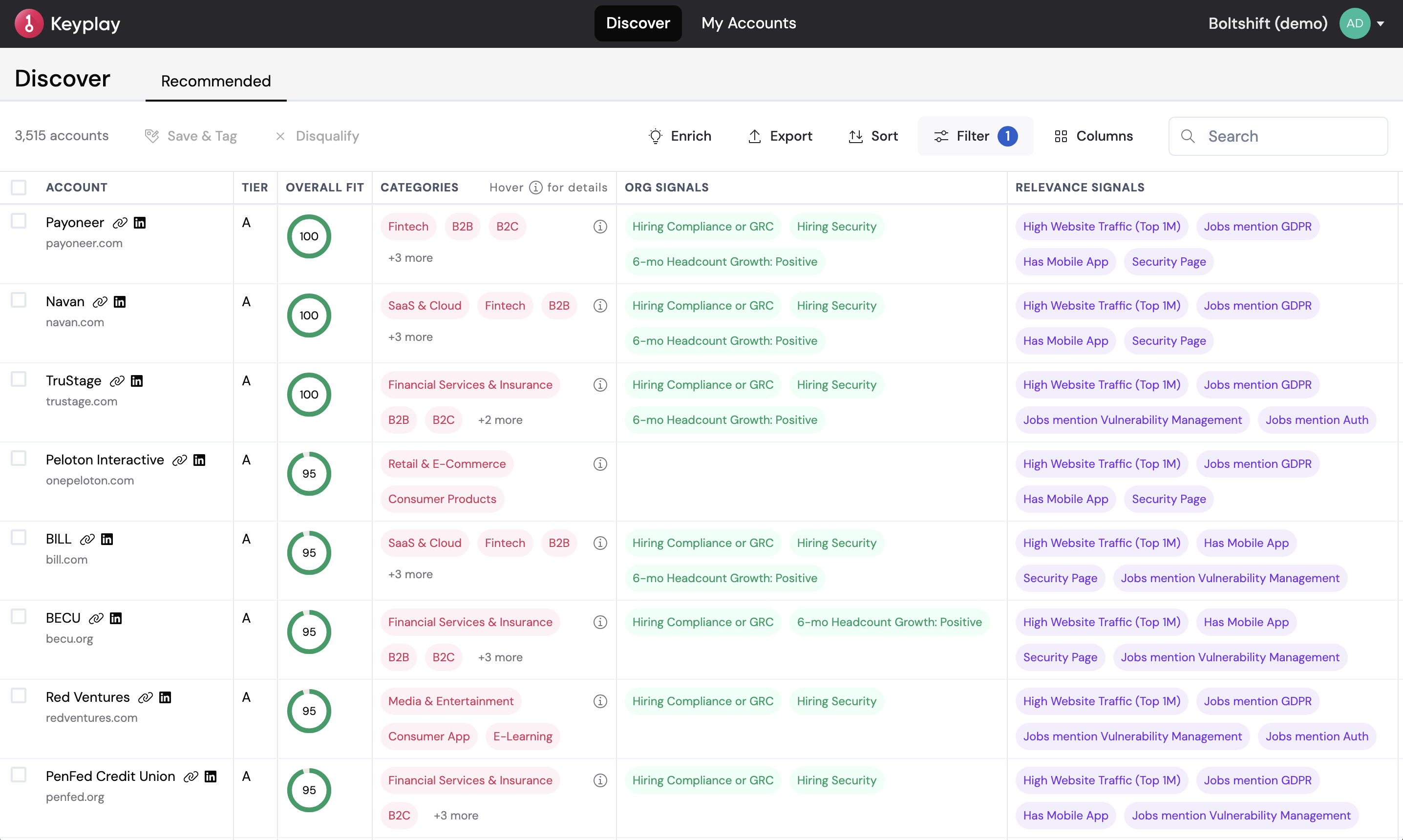

2) TRANSLATE

Now that you have a clear understanding of which “signals” your best accounts have in common. It’s time to translate that clarity into an ICP Model that consistently and accurately scores your target accounts.

Keyplay’s product is purpose-built for this use case, but you could also do this on your own by stitching other tools together.

In Keyplay, we use weighted fit signals and AI lookalikes as the inputs to your model.

3) TEST

Backtesting helps you prove and improve your model (and it is especially useful in building trust and buy-in internally).

The key to backtesting is contrast. Instead of comparing great customers to OK customers, you want to compare your best customers to DQ’d leads, those prospects who are an absolute waste of marketing and sales resources.

Once you have your two lists, you can test each tweak you make in your model against them.

Keyplay’s new Model Backtester lets you do this in a couple clicks:

4) IMPROVE

Our best customers treat ICP as a program, not a one-off project.

Instead of building a static model once, they revisit their model consistently to make sure it stays accurate, and to improve it as they learn more about who their true ICP is.

For smaller companies, a quarterly cadence is right. For larger organizations, a bi-annual or annual cadence works better.

Case Study: Mutiny’s ICP Modeling Journey

Mutiny doubled deal size and increased pipeline by 35% by building and actioning on their own ICP model.

We recorded a webinar with their team diving deep into how they did it. You can watch it here.

Next Steps

If you’ve read this far, you’re serious about building your own ICP Model. Here are some resources to help you on your journey:

1:1 Support from the Keyplay Team

At Keyplay, we do free ICP Studies for our best-fit prospects. If you’re serious about solving this problem, we’ll build a preliminary ICP Model for you to make sure our methodology will work for you. Talk to our team about building yours here.

Keyplay List Builder

If you can’t afford Keyplay’s full solution, and want to build a target account list on your own, you can use our List Builder tool– it’s free.

Follow us on LinkedIn

We obsess about this problem. If you want to stay up to speed with everything we’re learning, follow us on LinkedIn, and subscribe to receive upcoming research.