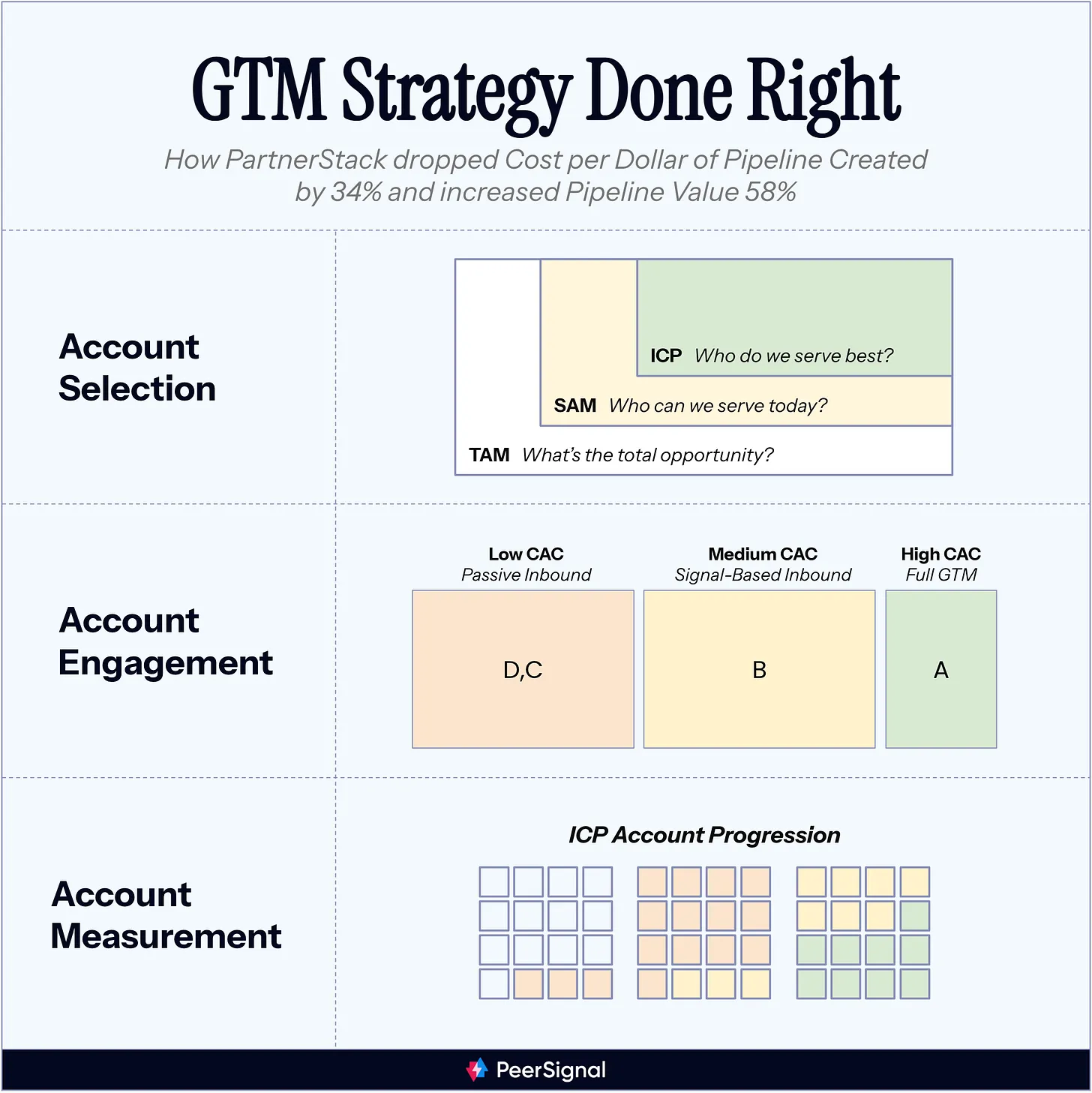

How PartnerStack Cut Cost per Dollar of Pipeline Created by 34% and Increased Pipeline Value by 58% with Keyplay

Campaigns without connective tissue, messaging without a market, and decks filled with “ideas” instead of outcomes.

Random acts of marketing. We’ve all been there.

Of course, in the early stages of the startup journey, this experimentation is invaluable. But the best CMOs evolve their function into a strategic, repeatable, and formidable pipeline-generating machine.

This is the exact evolution Tyler Calder led PartnerStack’s marketing team through. In today’s newsletter, we dive into how they:

Map all the accounts they care about getting (and who they don’t).

Prioritize who to focus on now.

And run coordinated plays to predictably create quality pipeline from those accounts.

It’s working. Since the shift their GTM team has dropped cost per dollar of pipeline created by 34% and increased pipeline value 58%. All while continuing to hit and exceed aggressive growth goals.

Account Selection: From Spray and Pray to Precision Targeting

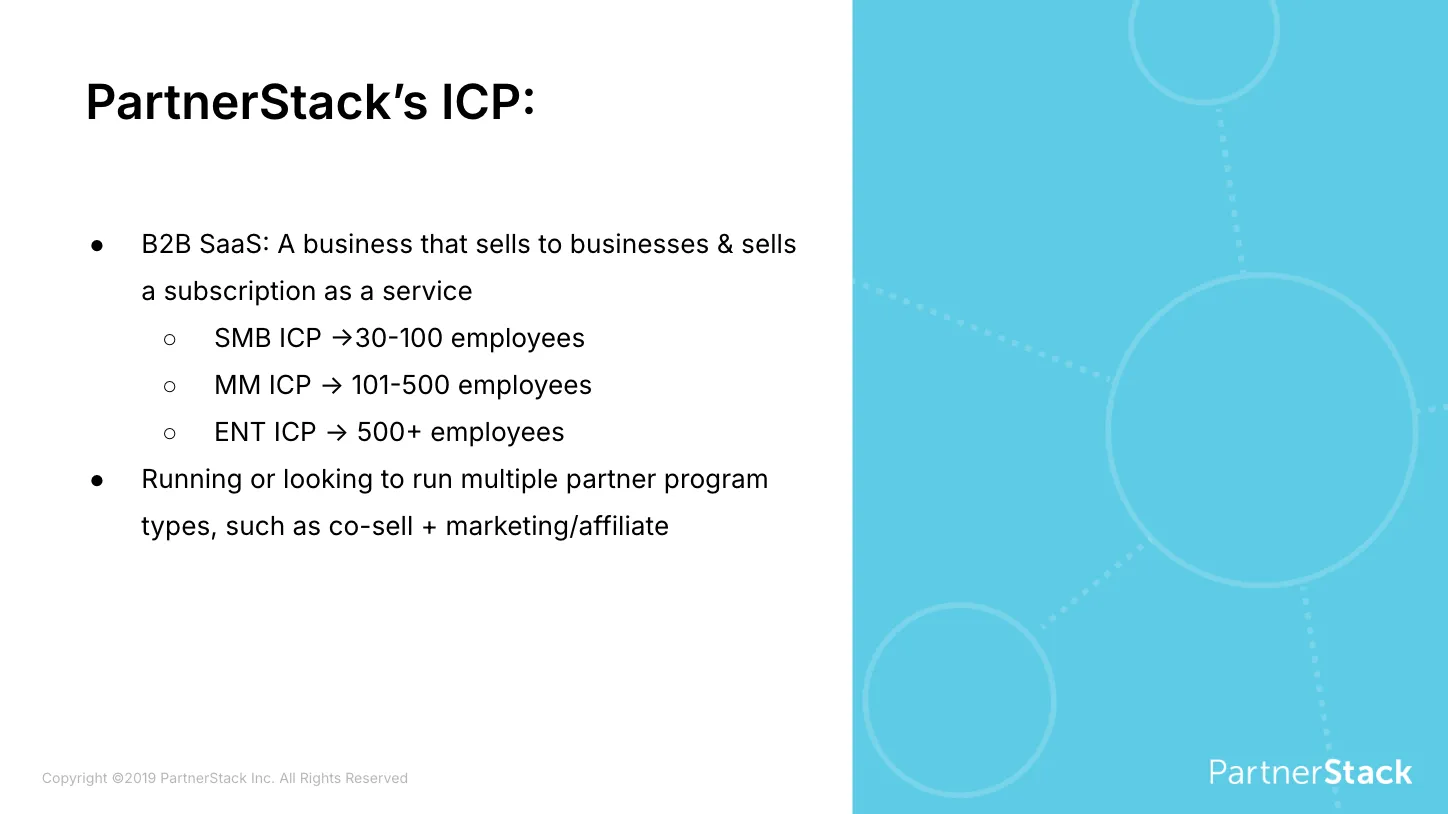

Like everyone, PartnerStack started with what Tyler calls “the typical SaaS ICP”. General firmographics based on high level industry and company size:

Tyler’s original ICP Definition

Tyler’s original ICP Definition

The problem with this definition of your market is that it’s too surface-level. They were bringing in customers who fit their documented ICP perfectly, but still struggled to onboard, were slow to retain, or churned faster than others.

B2B, broad employee size bands, and “running or looking to run multiple partner program types” are not granular enough filters to accurately score fit.

Which meant they were wasting spend on non-ICP accounts that they couldn’t even prove were non-ICP. So they couldn’t fix the root cause of the problem.

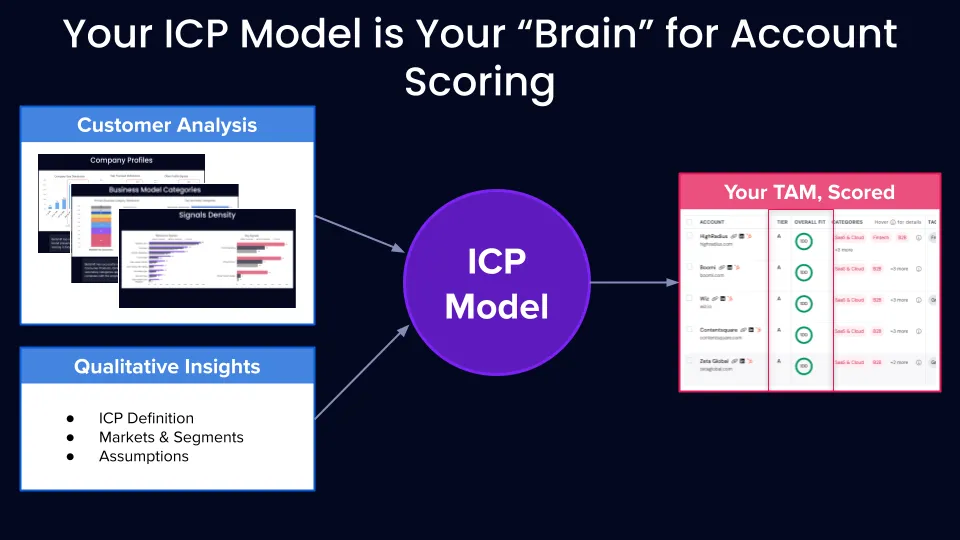

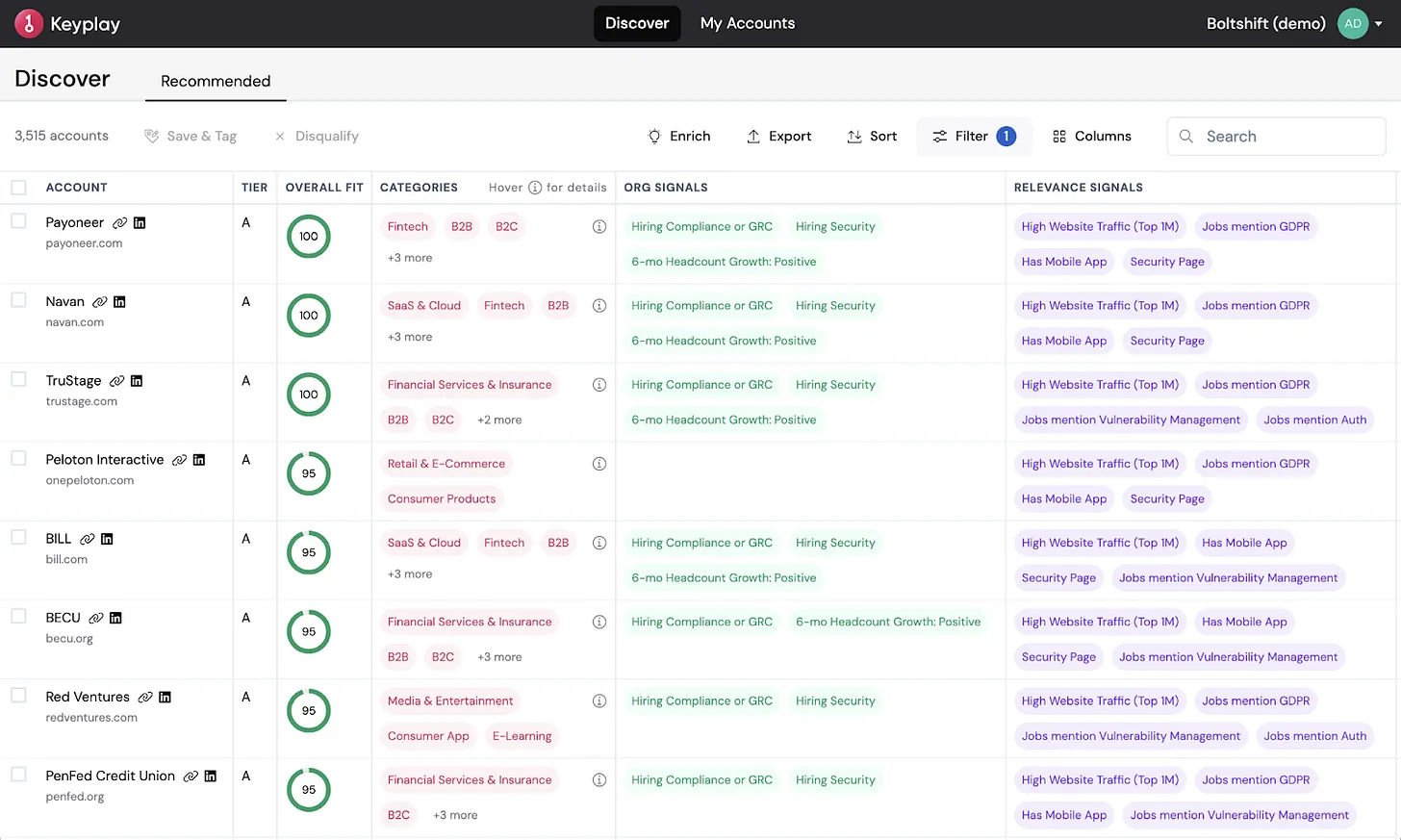

Tyler and his team worked with Keyplay to solve this with a testable ICP Model.

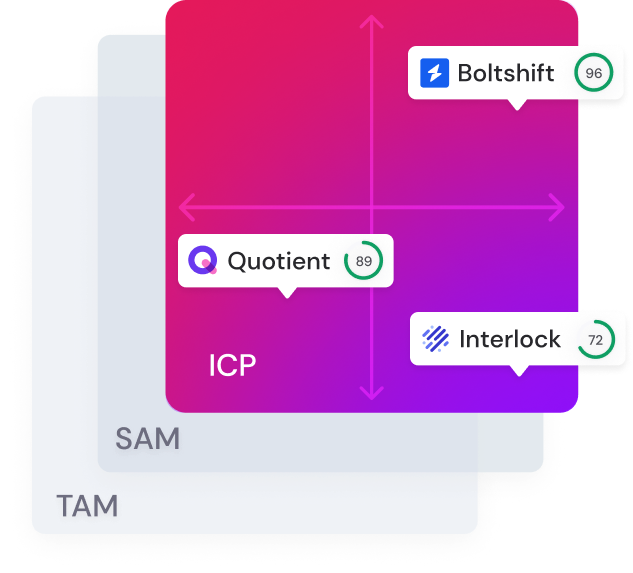

This model wasn’t just a PowerPoint. It’s translated to a clear list of target accounts, integrated with the CRM, and dynamically updating as things change.

An example output from an ICP Model built in Keyplay

An example output from an ICP Model built in Keyplay

And he could prove, with backtested fit signals why these accounts scored the way they did. This was essential in getting the buy-in necessary to go full account-based.

Market Prioritization: Where to Focus

I asked Tyler to share their approach here; these are his words:

Most people think prioritization is about cutting accounts. Ours is about compounding confidence—in where to place bets, and where not to.

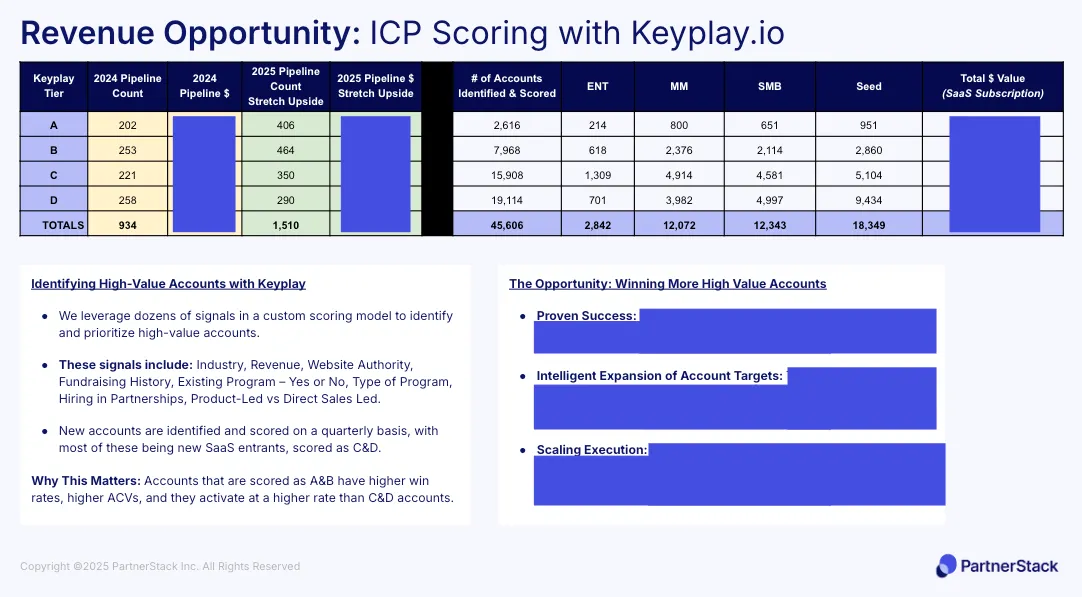

We use our scoring system powered by Keyplay, which looks at 40+ data points across tech stack, hiring behavior, partner program maturity, and GTM infrastructure. That includes things like:

Are they using a PartnerStack competitor?

Are they actively hiring for partnerships?

Do they have multiple partner motions live (affiliate, referral, agency)?

Are they growing? Recently funded? Product-led? Employee count?

Are they investing into areas that partnerships could either compliment or displace because it’s more efficient?

Each account gets scored and tiered:

Tier A: 70%+ score. High-fit, high-readiness. These are our best NRR performers, proven over 24 months.

Tier B: 50–69%. Strong potential, often missing one key signal (e.g., not hiring yet).

Tier C/D: Below 50%. Lower intent or maturity, but still on our radar.

We revisit this quarterly, not annually. Markets shift fast—so we use these scores to catch Tier C accounts on their way to becoming Tier Bs. That lets us get in early, and grow with them.

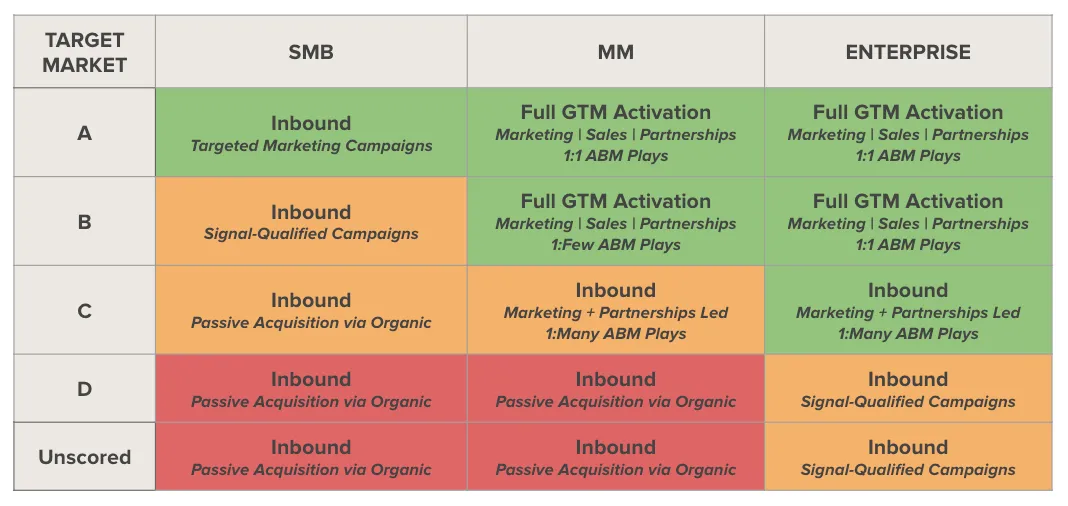

From there, we layer GTM plays by Tier:

Tier A: Gets the full orchestra—custom landing pages, executive alignment, direct mail, paid media, dinners, and coordinated sales+marketing+partner plays. Most of our content that we develop is aimed at this audience as well.

Tier B: Similar intent, but lighter lift—digital-only ABM, SDR/BDR follow-up, and nurture streams.

Tier C/D: Mostly passive. These accounts come in through organic, brand, or partner referrals. We keep CAC low by letting word-of-mouth and our excellent execution with things like technical SEO do the work.

We also run joint ABM programs with top partners targeted at A&B accounts.

Our guiding question:

What’s the cost to generate $1 of pipeline in this segment?

If it’s under threshold, green light. If it’s above? We ask whether it helps us in other ways—brand halo, category creation, or breaking into a new motion or vertical. ROI isn’t always short-term. But it has to be earned.

Most importantly, GTM is one team.

Marketing, sales, partners, execs, and customer success—we all own these tiers. It’s just a function of where each puts the effort, and that may ebb and flow depending on how things are performing. Generally though:

Leveraging Prioritization to Anchor Focus

These tiers allow their team to align their programs to clear, defensible ROI.

In Tyler’s words:

Green = We can spend more to acquire these customers, based on what we know in the data about the keyplay tiers + segments. So our lift and GTM execution changes accordingly.

Orange = These are solid for us, but we can’t be as aggressive with our CAC, so we count more on Inbound, either through organic acquisition (SEO) or through marketing & partnerships driven acquisition vs the ENTIRE GTM team, having sales do outbound, executive outreach etc…

Red = We need to be careful and make sure we’re properly qualifying anything that comes inbound. We don’t spend any resources actively trying to acquire these.

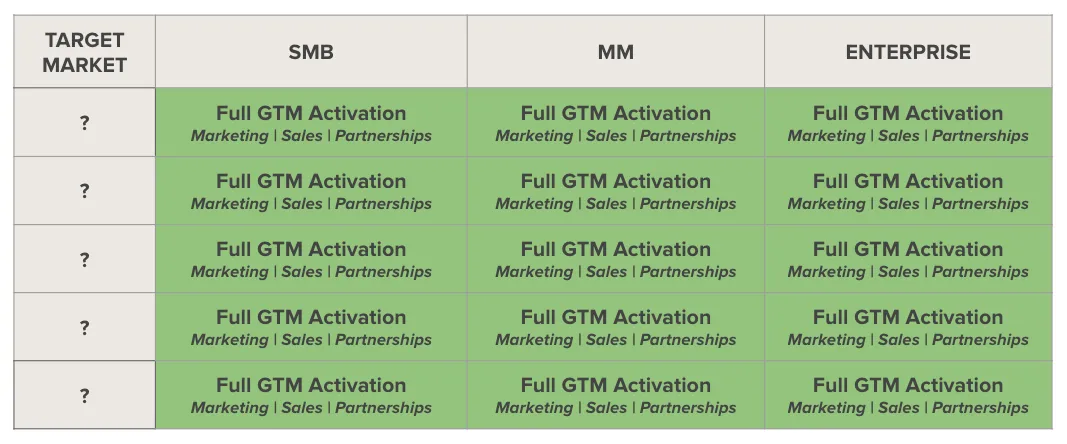

Before this – we were just throwing everything we had out into the market and seeing what stuck. Effectively, it would have looked like this:

Measurement: From Vibe Checks to Operational Excellence

They leverage this data both internally and externally.

Internally, they create weekly reports on how they’re penetrating the accounts they care about– their ‘weather report’. This keeps the team tightly aligned on how they’re pacing and why.

Externally, they can report on exactly who they are focused on acquiring, why, and for how much. They have clear, defensible, and actionable data that most investors and boards dream about.

Find. Score. Track.

Ready for your ideals accounts? We make it easy to get started and won't break your budget.